Interpreting Financial Reports

Course Purpose Learners who achieve this unit standard are able to interpret an income and expenditure statement and use information in the statement to make a financial decision. What you’ll learn Learners who achieve this unit standard are able to …

Overview

Course Purpose

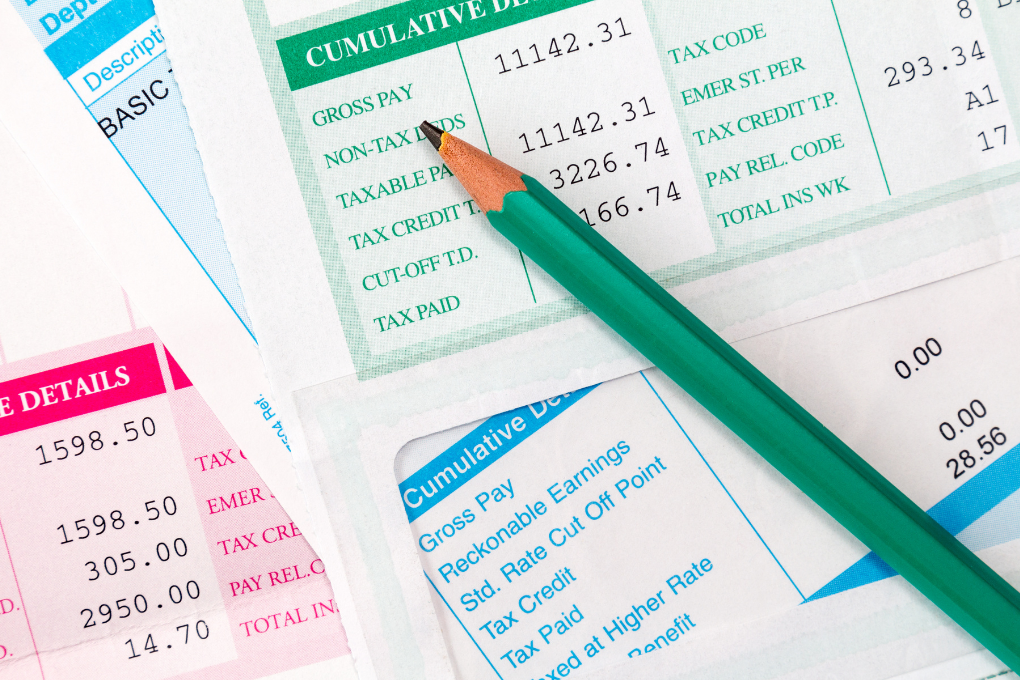

Learners who achieve this unit standard are able to interpret an income and expenditure statement and use information in the statement to make a financial decision.

What you’ll learn

Learners who achieve this unit standard are able to interpret an income and expenditure statement and use information in the statement to make a financial decision. The qualifying learner is capable of analysing the basic elements of an income and expenditure statement. Analysing the basic elements of a balance sheet. Compiling a personal assets and liabilities statement. Using the evidence in financial statements to make a financial decision.

Duration: 1 Day

Featured Course

Shape and motion in 2 – and 3-D space

Course Curriculum

Curriculum

Curriculum

- 4 Sections

- 7 Lessons

- 1 Day

- Unit 1: Analyse the basic elements of an income and expenditure statementASSESSMENT CRITERIA1

- Unit 2: Analyse the basic elements of a balance sheetASSESSMENT CRITERIA1

- Unit 3: Compile a personal assets and liabilities statementASSESSMENT CRITERIA1

- Unit 4: Use the evidence in financial statements to make a financial decisionASSESSMENT CRITERIA4

- 4.1The financial strengths and weaknesses of an entity are analysed and suggestions are made of ways to improve income and reduce costs.

- 4.2The concept of a cost to income ratio is explained and suggestions are made on how to improve the ratio.

- 4.3The relationship between turnover, income, revenue, sales/earnings and profit is explained with examples.

- 4.4The concept of cash flow is explained in terms of liquidity.

Requirements

- Grade 11

- NQF Level 3